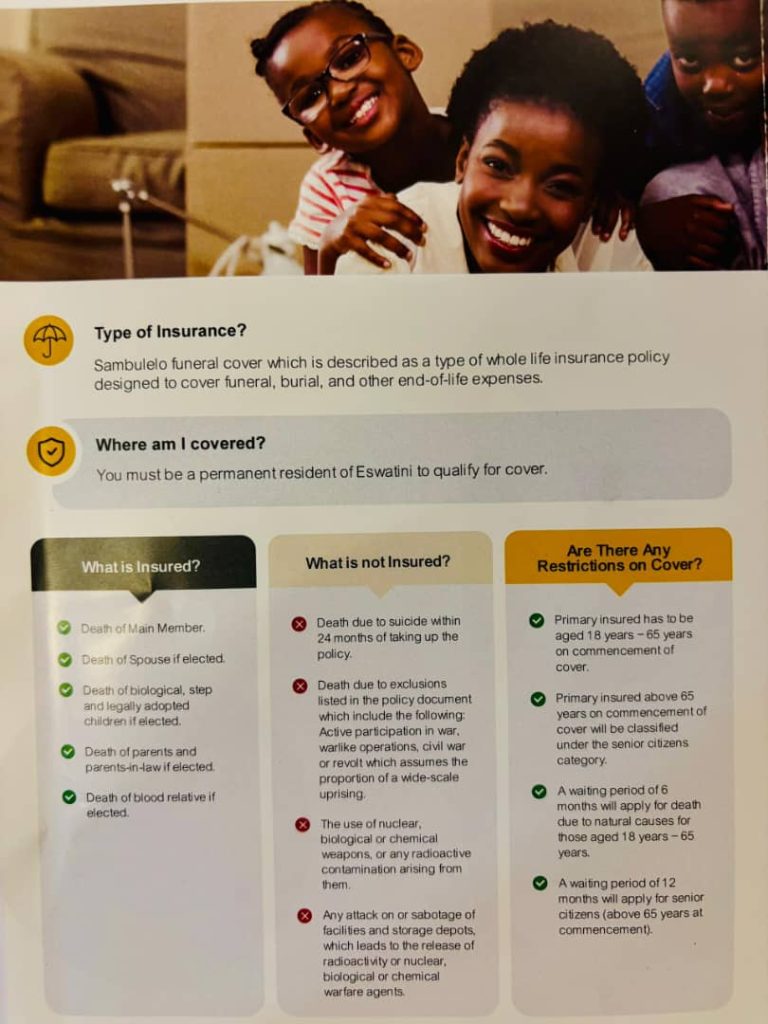

The Eswatini Development Finance Corporation (FINCORP) has officially launched a new funeral insurance product, the Sambulelo Funeral Cover, through its subsidiary, FINSURE Assurance Limited.

Speaking at the launch event at the FINCORP headquarters in Mbabane on Thursday, Group Managing Director Dumisani Msibi said the product was created to ease the financial burden often associated with funerals while promoting the Group’s goal of increasing financial inclusion in the country.

“Funerals are not only moments of grief but also times of significant financial strain for many families. The Sambulelo funeral cover is our response to customer needs,” Msibi stated.

He added that despite being relatively new, FINSURE Assurance has already ranked among the top five insurance companies in the country, demonstrating the Group’s growing influence in the financial services sector.

Msibi congratulated the FINSURE team for developing the product and obtaining approval from the Financial Services Regulatory Authority (FSRA).

“Mine at this point would be to congratulate the FINSURE team for the excellent work that has been put into developing this new product, from coming up with the concept, presenting it to EXCO, submitting it to the Board of Directors, and finally securing the FSRA’s formal approval leading up to the launch today,” he said.

During a presentation, FINSURE Assurance Limited Chief Insurance Officer Nozipho Dlamini stated that the Sambulelo funeral cover was developed with a thorough understanding of the financial challenges faced by SMEs, sugarcane farmers, hawkers, vendors, and the informal sector. She explained that the cover offers flexible options for coverage and payment structures to align with the cash flow cycles of these groups.

“Our customer proposition hinges strongly on inclusivity and accessibility; all emaSwati should be able to access funeral cover regardless of their economic or social status. We are not imposing a product but offering a needed solution whose structure reflects the heartbeat of that group or entity,” Dlamini clarified.

She mentioned that the initial focus would be on community groups of 20 or more, leveraging the country’s culture of collective support during times of loss.

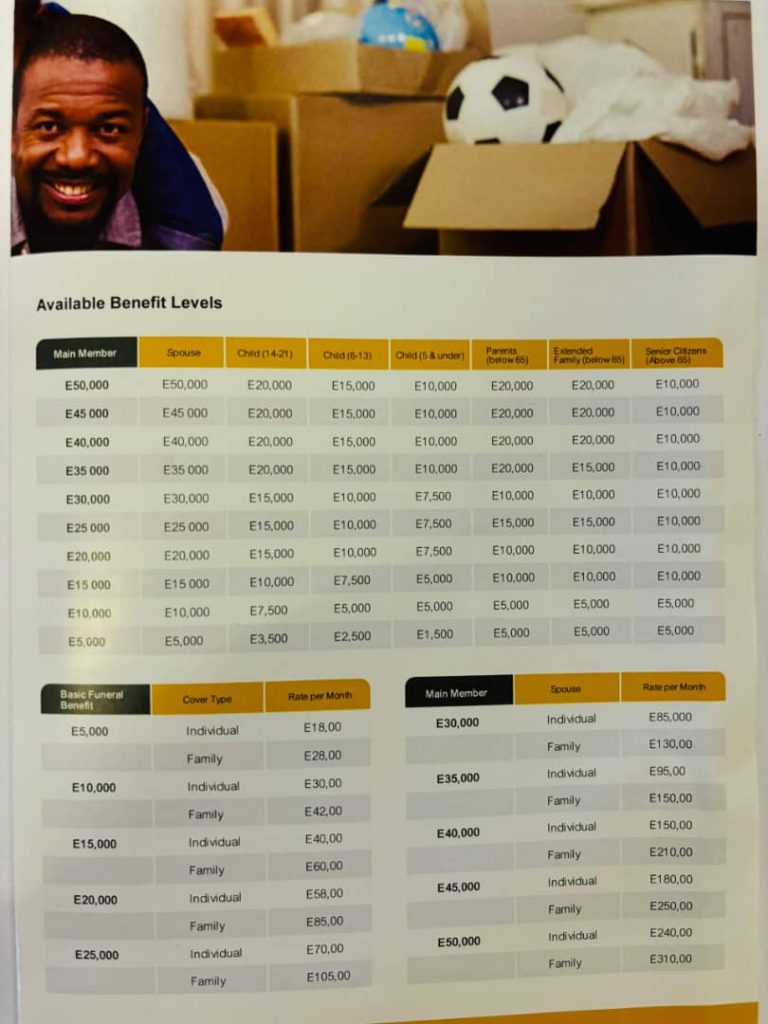

The Sambulelo funeral cover will present flexible options for individuals, immediate families, and extended family members, with coverage from E5,000 to E50,000. Senior citizens over 65 will have a maximum cover of E10,000, while extended family members can be covered up to E20,000.

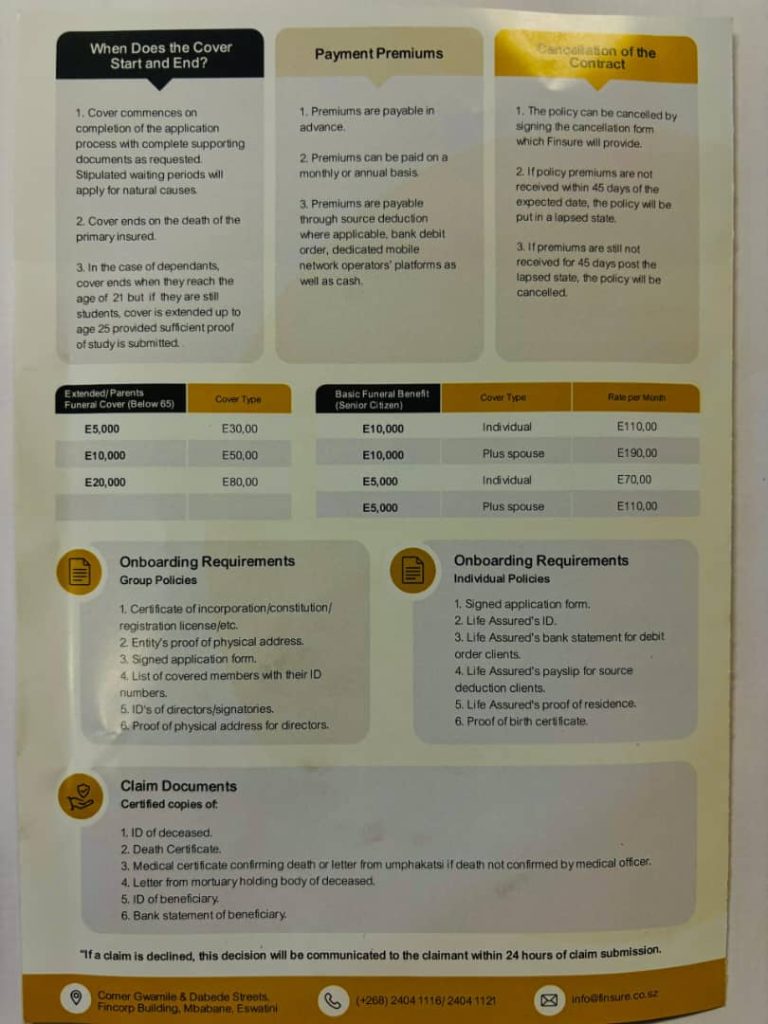

The coverage begins once the application process and all supporting documents are completed, with specific waiting periods for natural causes. Coverage ends upon the primary insured’s death or, for dependents, at age 21, extended to 25 for students with proof of study.

Key features include payouts within 24 hours, paid as a lump sum into the beneficiary’s account, and coverage for biological, step, and legally adopted children up to 21 years old, extended to 25 if they are still studying, along with lifetime coverage for permanently disabled dependents. A six-month waiting period applies for natural death, but is waived for transferring schemes. Standard exclusions include deaths resulting from active participation in war or riots.

Premiums are payable in advance and can be paid monthly or annually. Payment methods include source deductions, bank debit orders, dedicated mobile network operator platforms, and cash. The policy can be canceled by signing a cancellation form from FINSURE. If premiums are not received within 45 days of the due date, the policy lapses, and if unpaid for 45 days after lapse, it will be canceled.

The cover will be available at FINCORP and FIRST FINANCE outlets in Mbabane, Manzini, Nhlangano, Siphofaneni, and Tshaneni, ensuring coverage across the country.

A breakdown of the Sambulelo Funeral Cover