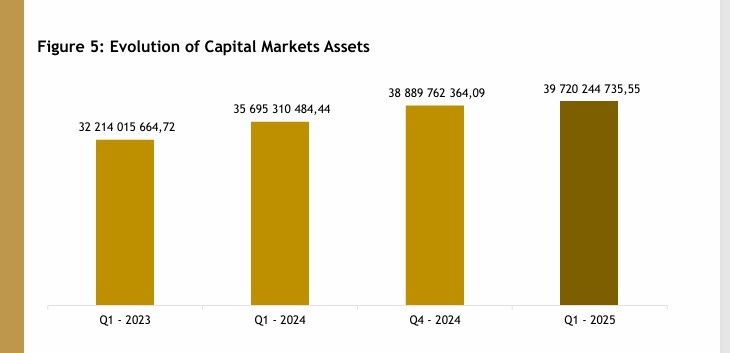

The Financial Services Regulatory Authority (FSRA) Quarterly Statistical Report for the first quarter of 2025 (Q1 2025) indicates that Eswatini’s total capital market assets increased by 2.14% quarter-on-quarter and 11.28% year-on-year, reaching E39.72 billion in Q1 2025.

This is up from E38.89 billion in the previous quarter and E35.70 billion in the same period last year. The performance was largely driven by gains on the Johannesburg Stock Exchange (JSE), strong gold prices, and the strengthening of the South African Rand against the US dollar.

The positive movement in South African equities yielded good returns for asset managers, particularly in equity portfolios. The geographical allocation of capital market assets shifted notably, with domestic market allocation increasing to 41.54% compared to 39.64% in the previous quarter. Allocations to the Common Monetary Area and offshore markets saw slight declines.

Retirement funds continued to dominate the market, accounting for 73.43% of capital market assets. Local companies followed with 10.7%, while collective investment schemes (CIS) held 6.88%. Retail investors made up 4.35%. Assets under CIS increased marginally by 0.07% to E8.92 billion, with retail investors’ funds growing by 11.37% and short-term insurers increasing their holdings by 10.38%.

Stanlib maintained its leading market share within CIS management, holding 47.38%, followed by African Alliance with 41.63%, and Old Mutual at 10.20%. Notably, retail investor activity drove Stanlib’s market share growth, while African Alliance experienced a slight decline due to reduced SACCO investments.

Assets under advisory also posted growth, increasing 2.75% in the quarter to E30.80 billion. Retirement funds accounted for the bulk of these assets at 82.08%, although this represented a slight decline from the previous quarter. Companies contributed 8.63% while collective investment schemes added 6.05%.

Market concentration remained high, with Stanlib leading at 44.11% share of assets under advisory, followed by Inhlonhla at 14.13% and Old Mutual at 11.10%.

Overall, the first quarter reflected resilience in Eswatini’s capital markets despite global uncertainties. The sector benefited from positive external conditions, particularly the JSE’s strong showing and favourable currency movements. The FSRA emphasised that retirement funds continue to play a central role in shaping the industry’s performance.

The upward trend in both assets under management and assets under advisory underscores the sector’s importance in mobilising domestic savings and channelling them into productive investments.