By Own Correspondent

They arrived without spectacle, three women who had never sought the spotlight, yet became its most deserving subjects. Each walked a different path, through retrenchment, marriage, banking halls, and lecture rooms, but all carried the same armour: an unwavering culture of saving and strong discipline in handling money. Coincidentally, former students of St Theresa’s High School in Manzini, the trio reunited not for reunion photos, but to embody a national message that saving is not a luxury, it is leadership.

Their voices formed a quiet choir. “I lost my job, but I refused to lose my future,” said one. “I mastered a budget before it mastered me,” added another. “I chose integrity over self-enrichment,” reflected the third. They became the face of something far greater than an awards ceremony. They were living proof of a movement, a new tradition of trust.

When ENPF Chief Executive Officer, Ms Futhi Tembe, stepped forward to inaugurate the first-ever Lidlelantfongeni Stakeholder Recognition Awards, she was not launching a programme; she was unveiling a new culture of financial dignity.

“Today is more than just a recognition ceremony. It is a celebration of commitment, foresight, and the spirit of nation-building. Your voluntary contributions are not just numbers in an account; they are a testament to your belief in a secure future, not only for yourselves but for the generations to come,” she declared during the Voluntary Contributions Recognition ceremony at the organization’s headquarters in Manzini.

“At ENPF, we are driven by a vision of financial security and dignity for all our members. But that vision can only be realized through partnerships with people like you, who go above and beyond the minimum, who understand that saving is not a sacrifice, but an investment in peace of mind.”

CEO Tembe expressed that the dedication and financial leadership shown by the voluntary contributors are deeply inspiring to the Lidlelantfongeni team. This commitment is a challenge and a mandate to the fund itself; to continuously innovate and ensure that every single Lilangeni contributed is managed with the highest standards of integrity, transparency, and meticulous care.

She offered deep gratitude to those who choose to contribute voluntarily, thanking them not only for their trust but for their leadership in setting a critical example for others to follow. Looking ahead, Ms. Tembe conveyed excitement for the future, noting that with the continued support of its members, the fund will grow into a stronger, more resilient financial institution designed to fully serve the retirement needs of every emaSwati.

These awards, a pioneering weekly recognition series running until December 2025, honours individuals, employers and tenants whose commitment to the Fund goes beyond obligation. Unlike performance metrics or corporate rankings, these awards recognise mindset, the courage to do the right thing against all odds,, to plan when postponement beckons, and to lead quietly, without applause.

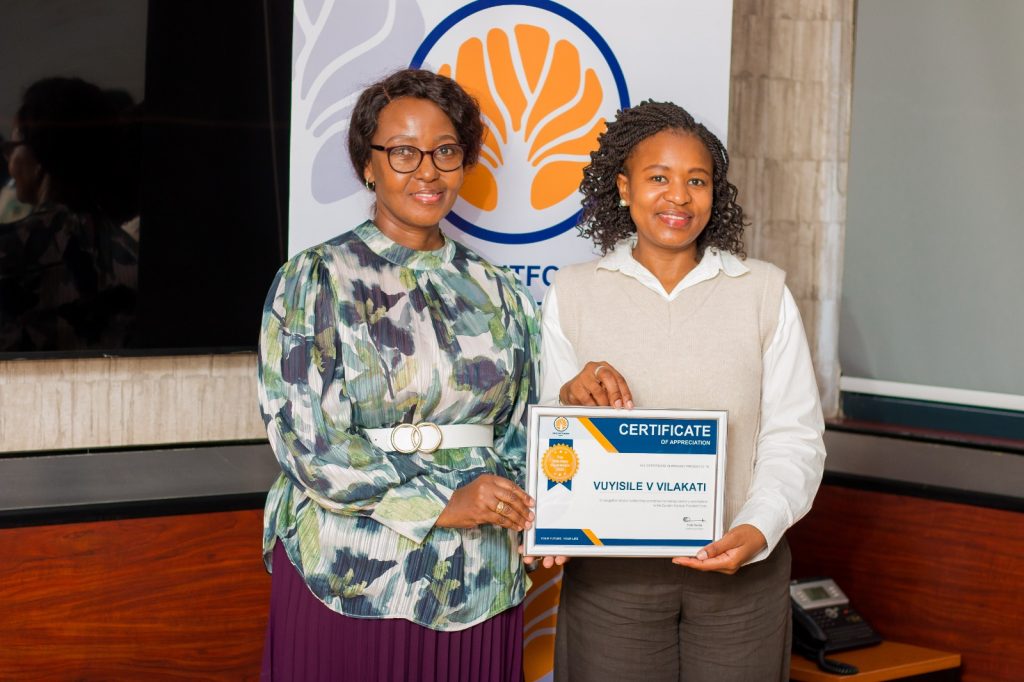

The first honourees were Ms. Vuyisile Dlamini, Ms. Lindiwe Shongwe–Masina, and Ms. Buselaphi A. Dlamini–Mokoena. They stood not as recipients, but as exemplars. They set a fine example for others through decades of consistent contributions, voluntary top-ups, and steadfast faith in an institution that has never betrayed their trust. In a world numbed by financial scandals, they stood as reminders that integrity is a currency too.

What distinguishes these awards is their soul and spirit of Lidlelantfongeni, meaning “those who build for tomorrow.” They are rooted in four guiding values: integrity, excellence, accountability, and service. In a society where many still believe someone else, family, children, fate, will carry them into old age, the awards aim to shift the narrative from dependency to self-determination.

As CEO Tembe remarked: “The seeds you plant today will grow into the shade that shelters your tomorrow. Keep planting. Keep believing. And together, let’s build a legacy of financial security, prosperity, and pride”.

Three Journeys, One Truth: Their Voices

Buselaphi Dlamini–Mokoena remembers the day life tested her resolve. In 2016, her employer in the Hospitality sector, closed shop resulting in her retrenchment. Many would have feared, spent, or surrendered. She reinvested. “When that pension came, I refused to squander it. I took a large portion, including what remained of my contributions, and invested them at Lidlelantfongeni.” Years later, when she lost her husband and was left to care for the children, it was not donations or dependency that upheld her, it was her own foresight. “Lidlelantfongeni has been my rock. No losses, no scandals. Just honest stewardship. I sleep because I know where my money lies.” Today, she teaches her children the habit to save.

Lindiwe Shongwe–Masina, after forty-one years in banking, speaks with the clarity of a banker and the conviction of a believer. “Financial freedom is earned through discipline,” she says. In her family, she was the anchor of saving, the guardian of budgets. She watched colleagues drown in debt cycles and swore never to live at the mercy of debt. “Even E200 a month is something. You don’t chase instant gratification; you build your comfort brick by brick.” She remained with Lidlelantfongeni after retirement for one reason: trust. “There has never been a cent lost there. No theft. No mismanagement. It is rare in this world.”

Vuyisile Dlamini began her journey at Swazi Bank, saving from an E800 salary. She was even able to buy her mother a lounge suite from her savings. Years later, as a lecturer at VOCTIM preparing for retirement, she searched for a new financial home. She tested two major institutions. Their answers unsettled her, fees, indifference, and erosion of capital. Her son, financially literate, guided her back. “He said, ‘Nkhosi, return to Lidlelantfongeni. They guard your future.’ He was right.” With her funds safely managed, she was able to fund a holiday in Cape Town with her husband; a trip paid entirely from disciplined saving. Now, at the advice of her son, she contributes even for their long-serving domestic helper. “Everyone deserves dignity in their old age,” she says.

Within every testimonial lay a unanimous tribute to ENPF and its flagship savings culture under Lidlelantfongeni. They spoke not of profits, but of peace. What they found was transparency, stewardship, and care, qualities rarer than returns. “When the world shakes,” one said, “I still sleep. Because my savings are safe.”

A Movement Larger Than Awards

These women may represent the first cohort, but they signal a broader awakening within the nation. The Lidlelantfongeni Awards are not merely decorative acknowledgments. They are strategic interventions, designed to demonstrate that pensions are not passive funds; they are instruments of nation-building. Every voluntary contribution strengthens not only the individual, but the national economy. Retirement is not an age; it is a decision.

This cultural shift must now include men. Across testimonies and narratives, it became evident that women have often led the saving culture. Men, too, must be encouraged; not to catch up, but to stand alongside, to lead households with prudence rather than pressure. Financial strength must become a family value, not a gendered burden.

CEO Tembe’s decision to personally present each award underscored a simple truth: leadership is presence. “Leadership,” she said, “means showing up for those who show up for themselves.” By 2025, a hall of honour will exist, built not of trophies but of stories, of teachers, traders, nurses, entrepreneurs, ordinary people who made extraordinary decisions.

The inaugural CEO Awards have done more than honour savers, they have repositioned savings as an act of self-respect. They have shown that wealth is not measured by what we spend, but by what we protect. Eswatini is entering a new chapter, one in which pensions are not paperwork, but pride. In which retirement is not feared, but prepared for. In which institutions are not distant, but dependable.