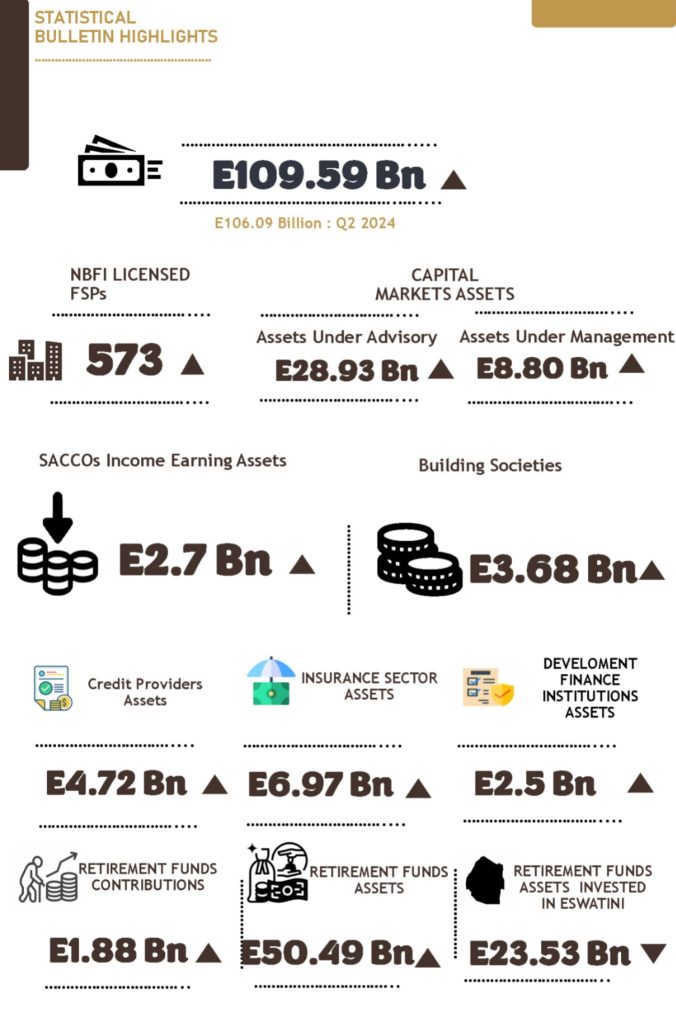

Eswatini’s Non-Bank Financial Institutions (NBFI) sector recorded significant growth in the third quarter of 2024, with total assets increasing by 3.58% to E110 billion, up from E106 billion in the previous quarter.

This is according to the Financial Services Regulatory Authority (FSRA) Quarterly Statistical Bulletin – Quarter 3 2024.

On a year-on-year basis, the sector registered a strong 9.82% growth, highlighting its resilience amid evolving financial market dynamics.

The quarterly expansion was driven by capital markets, which experienced a 8.31% rise in asset value, fueled by interest payments, bond coupons, and dividend payouts.

Other key contributors to the sector’s growth included short-term insurers (9.02%), reinsurers (8.71%), and long-term insurers (6.41%). However, Development Finance Institutions (DFIs) saw a decline of 5.82%, indicating challenges in this segment.

The bulletin notes that the capital markets sector remains a key pillar of Eswatini’s financial system, with total assets reaching E37.73 billion in Q3.

The increase was largely supported by the performance of retirement funds, which accounted for 74.81% of the total capital market assets. This underscores the continued reliance of capital markets on pension fund investments to drive growth.

As noted by the bulletin, domestic investments increased to 40.18%, while portfolios in the Common Monetary Area (CMA) and offshore markets declined. This shift indicates a growing preference for local investment opportunities.

Collective Investment Schemes (CISs) also showed a notable quarterly increase of 5.40%, bringing total assets under management to E8.80 billion.

The insurance sector was a significant driver of year-on-year NBFI growth. Short-term insurers recorded an 18.62% increase in assets, while long-term insurers and reinsurers posted gains of 13.97% and 14.07%, respectively. This growth reflects increased insurance penetration and stronger underwriting performance.

The long-term insurance (LTI) sector saw gross written premiums (GWP) surge by 51.56% to E776.92 million, largely due to higher retirement fund direct premiums. Net earned premiums also jumped by 65.25%, signaling improved underwriting profitability.

On the short-term insurance (STI) side, gross written premiums grew by 41.96% to E939.84 million, with motor and engineering insurance being the primary contributors. However, net claims incurred rose by 58.98%, mainly due to an increase in motor-related claims.

Retirement funds, which remain the backbone of the NBFI sector, recorded a slight quarterly asset increase of 0.76% to E50.49 billion. While local assets declined by 0.18%, foreign assets expanded by 1.59%, reflecting a balanced diversification strategy. Contributions rose by 12.88%, driven by higher employer contributions.

Investment allocations in the retirement funds sector continued to favor equities (63.12%) and long-term debt instruments (21.09%), emphasizing a focus on long-term growth and stability.

Savings and Credit Cooperatives (SACCOs) also posted a 1.53% increase in total assets to E2.98 billion, driven by financial investments and loan portfolio expansion. However, credit providers experienced a 12.45% decline in assets, signaling tightening lending conditions.